Finance Training – How AR, VR, and eLearning are Making Smarter Finance Teams?

In recent years, the Banking, Financial Services, and Insurance (BFSI) sector has experienced a seismic shift, primarily propelled by technological advancements. These digital integrations have revolutionized finance training services on a global scale, paving the way for more tailored, accessible, and inclusive solutions.

Fast-forward to 2022, when the BFSI security market was valued impressively at $55 billion. Projections indicate a staggering ascent to approximately $97.4 billion by 2028. Such rapid growth underscores the ever-increasing demand for adept professionals who navigate market complexities and champion innovation in an ever-evolving competitive environment.

In this post, we will explore the pros of using tech in the finance sector and its potential to boost the skills of professionals in this dynamic industry.

Table of Contents (Jump To):

- What is eLearning in Finance?

- Challenges Addressed By Digital Learning in Finance

- Seven Benefits of Using Superior eLearning In Finance

- What is AR & VR?

- 7 Ways in Which AR & VR in Finance Are Supporting Teams

- Ways to Implement AR & VR in Financial Services Training

- What is Financial Compliance?

- What is Financial Compliance Training?

- Why Does Compliance Training for Employees Matter?

- Why is Financial Compliance Training Crucial?

- Comprehensive Financial Compliance Training: Best Practices

- Conclusion

What is eLearning in Finance?

eLearning in finance refers to an online training approach that enables companies to equip their workforces with the skills and knowledge to perform their job roles efficiently, innovatively, and with the right mindset.

The primary mode of engagement is digital, thus offering flexibility and convenience to workforces in managing their jobs and learning commitments.

Today, the global e-learning market is growing fast to keep pace with businesses’ training demands. Valued at $210.1 billion in 2021, it is accelerating at a compound annual growth rate of 17.54% and is expected to exceed $848.12 billion by 2030. This highlights the increasing reliance of industries, including the BFSI sector, on digital learning platforms.

The finance sector has undergone several shifts, ranging from the rise of financial platforms and banks’ digital transformation to inclusive and personalized financial services. In this regard, e-learning offers a higher potential for scalability, personalization, and cost-effectiveness that traditional training methods often can’t match.

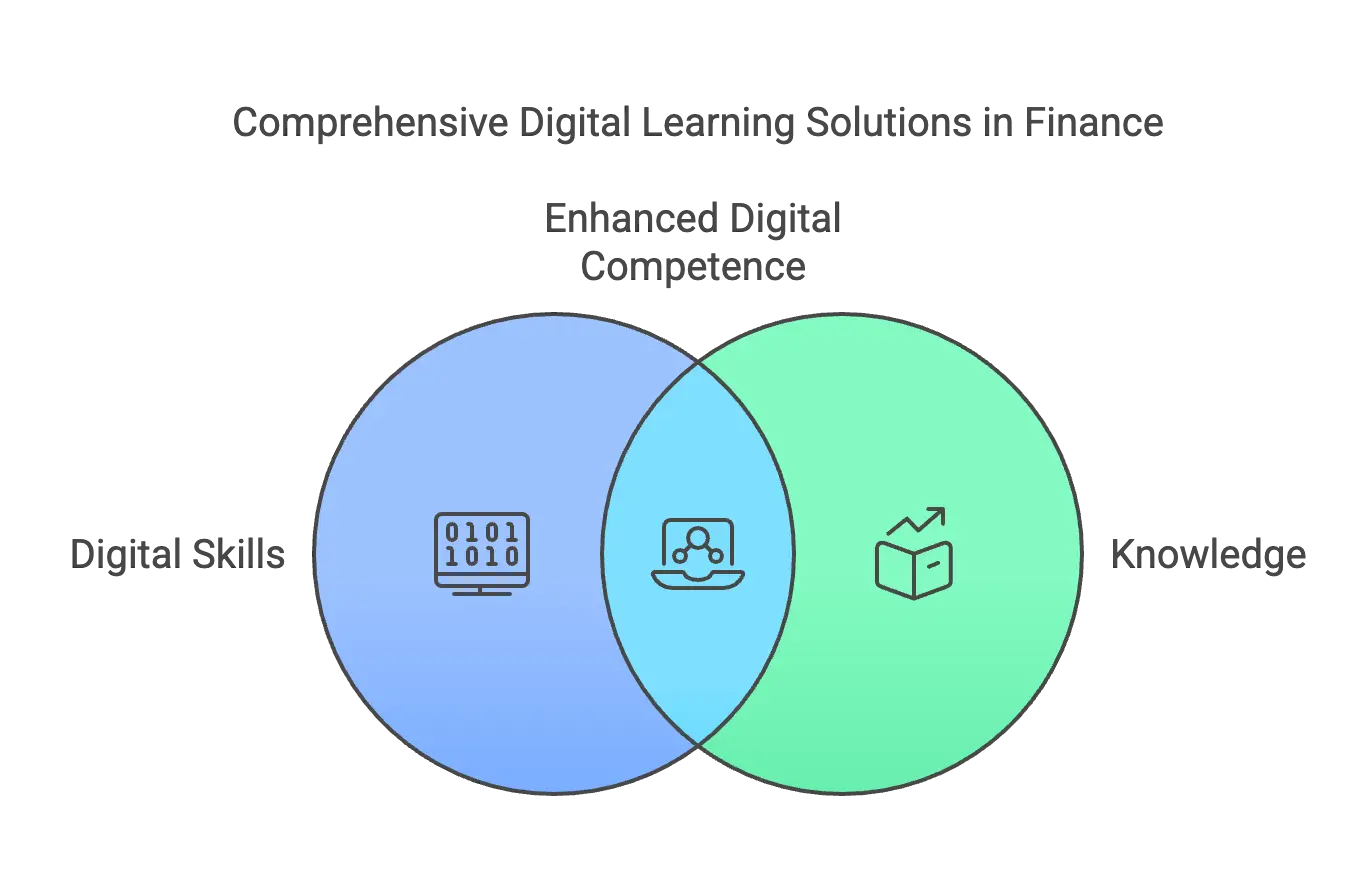

Challenges Addressed By Digital Learning in Finance

Below are the common challenges that the finance sector faces, which e-learning addresses proficiently:

1. Lack of Digital Skills

The rapid pace of digital transformation has left many professionals scrambling to stay updated. The consequence of this skill gap is more than just an inability to use new tools—it translates to decreased productivity, higher attrition rates, and missed opportunities.

2. Lack of Knowledge

Employees may lack important knowledge. For instance, the workforce can make basic errors without access to compliance training. Such oversights can result in businesses facing penalties, undergoing investigations, or, in severe cases, being forced to cease operations due to technical errors.

3. Lack of Customer-Centricity

A lack of customer-centricity drives customers away and towards competitors who place the customer experience at the center of their business model.

Seven Benefits of Using Superior eLearning In Finance

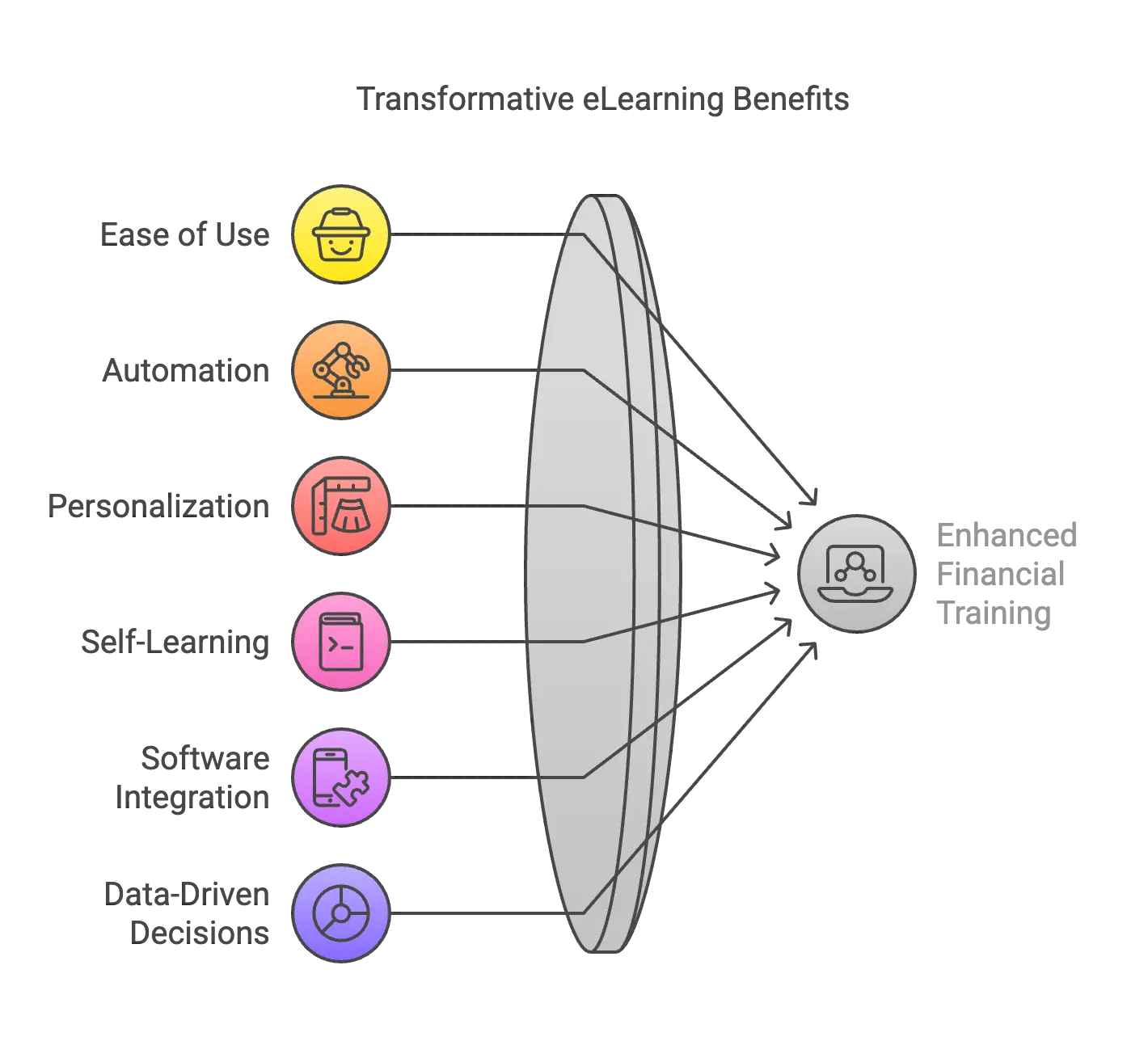

Using a single, unified, cloud-based, AI-powered Learning Management System (LMS) helps financial services businesses streamline their training operations.

Here are the top benefits of implementing superior eLearning in finance:

1. Ease of Use

Using a superior LMS enables businesses to completely streamline training operations through access to such a user-friendly interface.

- Admins can easily onboard all stakeholders – from employees to guest speakers.

- Admins can create, publish, and distribute learning content seamlessly and securely to learners.

- Content can be stored on the cloud and easily accessed at any time.

- Collaboration between team members, learners, and experts becomes seamless.

- Multiple authorized users can log in to the platform from any location and start learning.

2. Automation of Training Processes

All processes, from the creation of courses and dissemination, are automated, thus reducing the manual stress on admins and facilitators. Admins can deploy programs promptly, add new learning resources, and collaborate with learning groups and facilitators with ease.

Mentors, trainers, leaders, HR professionals, and other stakeholders can invest their activities in higher-value tasks.

3. Personalization of Learning Pathways

Studies show that 93% of high-performing organizations revealed that personalized learning supports employees in achieving professional goals more efficiently. Every professional’s needs, weaknesses, interests, and strengths are unique in the finance sector.

Rather than a one-size-fits-all, learning can be adapted to the specific needs of each learner’s job role, growth path, and projects. AI-powered LMS enables businesses to design and deliver a customized learning experience to finance workforces, boosting learners’ learning effectiveness and motivation.

Elements such as gamification can be introduced to add a healthy dose of competition, collaboration, and playfulness to the mix.

4. Promotion of Self-Learning

Businesses can host libraries comprising engaging mobile-optimized multimedia learning resources on the cloud. Resources can comprise a mix of bite-sized videos, audio representations, animated content, case studies, interactive eBooks, infographics, and slide shows, which can be consumed in a span of a few minutes.

Since these resources are accessible on demand, workforces are nudged toward self-learning, which reduces dependency on trainers and mentors.

5. Seamless Software Integration

Workforces may be using a wide range of additional software to do their work. Logging in and out of multiple software is a cumbersome task, which can demotivate them from learning. A superior LMS enables easy integration with all other software, thus bringing ease of use to the entire tech stack.

6. Data-Driven Decision Making in Training

Admins can track the progress of learners with the help of data insights. They can have a deeper understanding of what resources are working, the behaviors and habits of learners, and what areas need more support. The use of AI-powered predictive analytics, in this regard, helps admins understand future trends and plan financial workforce development accordingly.

7. Increased ROI from Training

The cost of training programs is considerably reduced with the use of superior LMS Businesses, yet learning effectiveness is increased. This way, companies enjoy the benefits of a skilled, relevant workforce.

The longevity of course content is extended, and its production cost is notably lower than traditional on-site, instructor-led sessions. Consequently, businesses can anticipate a heightened ROI through this sustainable training approach.

What is AR & VR?

AR or augmented reality uses digital information (visual, auditory, and other sensory information) and overlays that into the real world to enhance user experience. VR or virtual reality creates a simulated, artificial 3D experience where users can interact with that virtual surrounding.

The main difference between the two is that AR uses a real-world environment, whereas VR creates a virtual environment. With our fundamentals clear, let’s understand how these two technologies have impacted finance teams.

7 Ways in Which AR & VR in Finance Are Supporting Teams

Augmented reality and virtual reality in finance have been making teams efficient, productive, and more equipped to deal with the challenges of today and the opportunities of tomorrow. Here’s how:

1. State-of-the-Art Payment Systems

Approving transactions, enforcing authentication, and handling disputes are just some of the challenges finance teams face when using conventional payment systems. AR and VR in finance reduce payment trails even further and optimize each stage of the process.

With VR-backed payment systems, where customers can make payments without exiting the virtual world (think, metaverse), financial services are taking leaps and bounds.

For example, Mastercard partnered with Qualcomm Technologies and Osterhout Design Group (ODG) to allow customers to log in and pay using an iris scan.

2. Automated, High-End Security

With the threat of cybersecurity issues, financial teams are also better equipped with measures to protect customer privacy and the security of organizational assets like sensitive financial data.

For example, AR can enforce biometrics for identity verification that can connect to a VR world to prevent unauthorized access. These technologies can also simulate various breach scenarios to expose vulnerabilities and risks.

AR can also aid in meeting the Payment Card Industry Data Security Standard (PCI DSS) by protecting sensitive information for data security, regulating access, conducting security audits, maintaining a secure network, etc.

3. Almost-Real, Improved Remote Collaboration

With the finance world changing rapidly due to the increase in Fintech companies, global teams are the new norm.

Virtual reality in finance can help set up collaborative workspaces. These spaces will hold meetings that are like the real world and, in real time, can improve team engagement.

It can also facilitate better communication, replicating a face-to-face scenario. Another research study states that VR can facilitate better communication than other mediums.

4. Smarter Data Visualization

Traditional bars, graphs, and other data visualizations lag when compared to AR and VR-backed ones.

The latter makes it easier to analyze data that can be relayed into a physical space, offering a broader perspective as they increase their field of view. Risk assessment is also optimized.

When large chunks of data need to be studied to make crucial decisions, a 3D environment makes it much more efficient and immersive. Fidelity Investments, for example, has created a ‘StockCity’ where traders and investors can view stock portfolios in 3D.

Such data rooms can also be collaborative, where teams can negotiate, trade, and deduce.

5. Additional Support for Customer Service

Augmented reality in finance can make services more streamlined for customers, decreasing the dependency on calls, emails, and other forms of customer support.

Customer onboarding becomes efficient, too, with the increased ease of opening accounts and documentation, leading to more results in fewer efforts for finance teams.

Investor and portfolio management teams can also offer virtual tours of high-net-worth properties to help their clients make more informed investment choices.

For example, the National Bank of Oman uses an AR app, which makes it easy for customers to find the nearest ATM and the best offers in a mall or on any street in Oman. VR and AR in finance can also provide customers with interactive financial education.

6. Intelligent Simulation and Better Training

According to research, VR platforms offer higher subsequent knowledge retention.

Similarly, for upskilling and training, finance teams can use AR & VR for scenario-based and gamified learning. This can increase retention and make complex financial concepts easy to understand.

AR & VR can also simulate trades to minimize risk before performing those transactions in the real world, which is especially useful in portfolio management.

7. Targeted Customer Acquisition

A study found that for Gen Y and Gen Z, perceived ease of use, curiosity, social influence, and product features are some of the most important things to look for in digital banking, found a study.

This calls for augmented reality in banking, which helps meet the needs of future customers. Millennials and future generations, also prospective customers, have grown up in a tech-heavy world and are more likely to expect the same from the finance sector.

The finance industry is at high risk if it doesn’t keep up with this disruption. AR and VR in finance can help the teams keep the industry relevant and acquire more customers by enhancing the ease of use, user experience, and efficiency.

Ways to Implement AR & VR in Financial Services Training

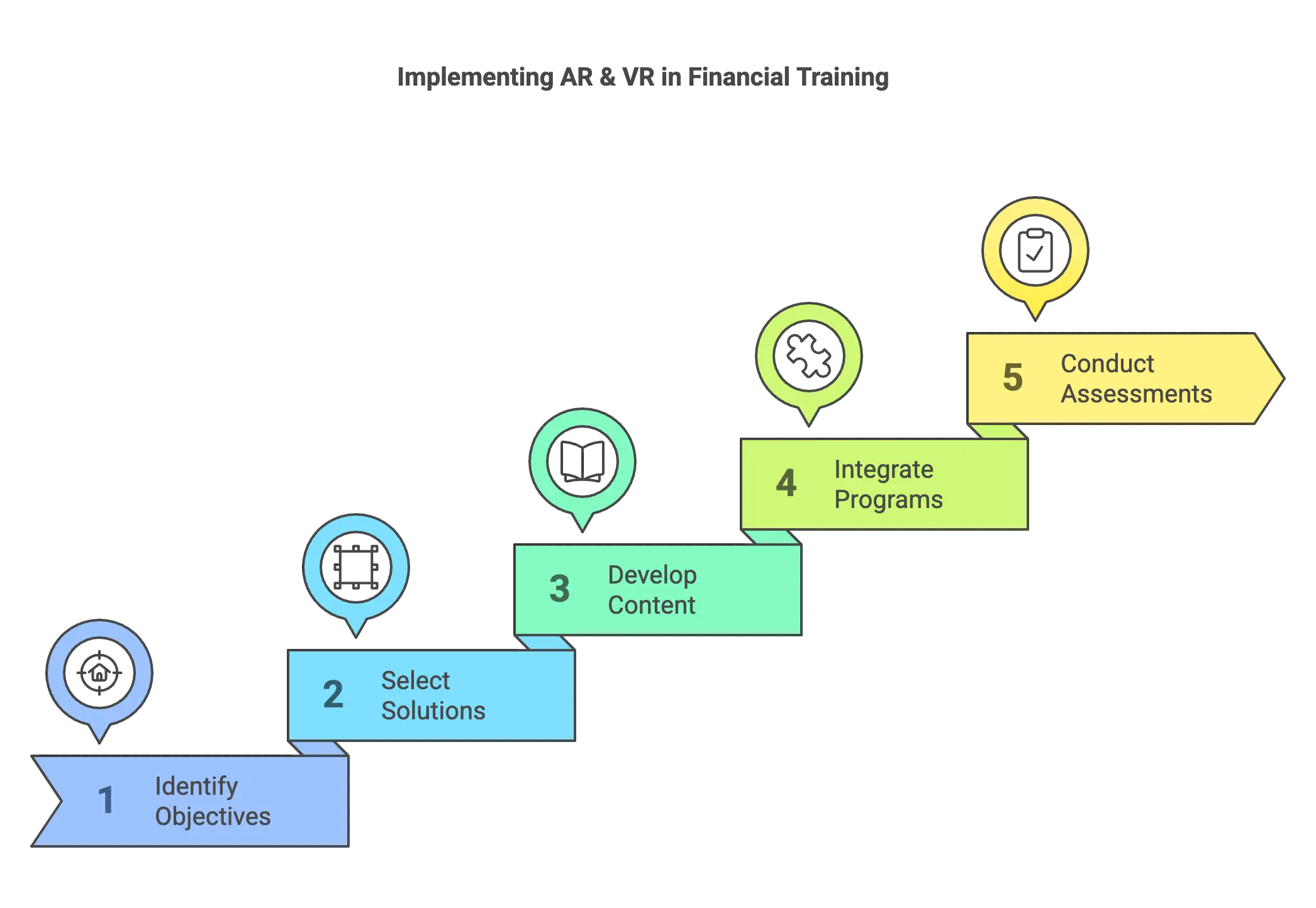

There are many advantages to introducing AR and VR in financial enterprise training. Now, let’s check out a few methods through which you can implement this technology to make them a reality;

1. Identify Training Objectives

Lay the foundation of your VR-powered bank teller training by setting clear objectives. This entails outlining a comprehensive blueprint highlighting what you aim to achieve from the program.

This could involve training bank teller aspirants to meticulously verify customer identification, handle financial documents, furnish account-related information, resolve basic customer queries, etc.

2. Select the Right Solutions

Establishing the training premises is essential for incorporating AR and VR in any financial service training.

So, once you have set your objectives, check out a few VR solutions whose features align with your needs. For instance, if you want to train a bank teller in customer interaction, you can equip them with a VR headset to let them practice in a virtual setup.

You can choose from many hardware like VR headsets, motion controllers, consoles, and software like VR development platforms, browsers, and simulation software.

3. Develop Content

The next crucial step is creating relevant content for the training program. You can choose to create custom content or optimize pre-existing resources from the internet.

To impart training with VR, you can use many content options, such as guided exercises, assignments, quizzes, or other simulation-based activities. Your main focus should be to make them as engaging and interactive as possible.

4. Integrate with Existing Training Programs

To enhance training effectiveness, it’s ideal not to rely entirely on a single teaching model. Following a blended approach involving classroom learning and simulations fosters better results – 73% of educators swear by it.

So, if you have an existing financial training program in place, integrate it with VR. This will make the training experience more engaging, immersive, and complete.

5. Conduct Regular Assessments

Once the VR-enhanced learning system is operational, conduct regular follow-ups and assessments. This regular intervention ensures the course is relevant and misses no crucial aspect.

So, routine tests and evaluations should be held, and feedback from learners should be gathered to measure the program’s efficiency. Then, you can use this data to refine and optimize the curriculum to make it more potent.

What is Financial Compliance?

According to a report, financial crime compliance costs have risen for 99% of financial institutions in 2023. Now, that’s a huge jump! But do you know why this happens? Most employees have little to no idea about financial compliance standards.

Financial compliance encompasses a set of laws and regulations designed to promote transparency and accountability across all aspects of the financial sector, from capital markets to retail banking.

These measures aim to protect consumers, investors, and the broader economy by ensuring fair practices, accurate reporting, and ethical conduct within financial institutions.

The compliance regulations protect against any financial crime, money laundering, and market manipulation.

What is Financial Compliance Training?

Financial compliance training refers to specific training programs where employees are given the knowledge they need to comply with financial industry regulations.

Financial governance training covers various topics ranging from Sarbanes-Oxley, insider trading, and anti-money laundering.

Why Does Compliance Training for Employees Matter?

A good financial organization’s foundation is informed and obedient personnel.

Employees who receive financial compliance training are invaluable because it gives them the knowledge and abilities to negotiate the complex web of financial requirements successfully.

Here are some compelling reasons why it matters:

1. Mitigating Risk

Compliance training significantly reduces the risk of legal and regulatory violations. Employees well-versed in the rules are far less likely to make mistakes that could result in costly penalties.

2. Enhancing Reputation

Maintaining a reputation for ethical and compliant operations is invaluable in the finance industry.

Compliance training ensures that employees act in ways that reflect positively on the organization, building trust with clients and investors.

3. Staying Ahead of Changes

The regulatory landscape in finance is ever-evolving. Compliance training helps employees stay abreast of the latest changes, ensuring the organization remains adaptable and compliant.

4. Legal and Regulatory Adherence

Financial firms must abide by a myriad of requirements. By guaranteeing adherence to these regulations via compliance training, legal problems are prevented.

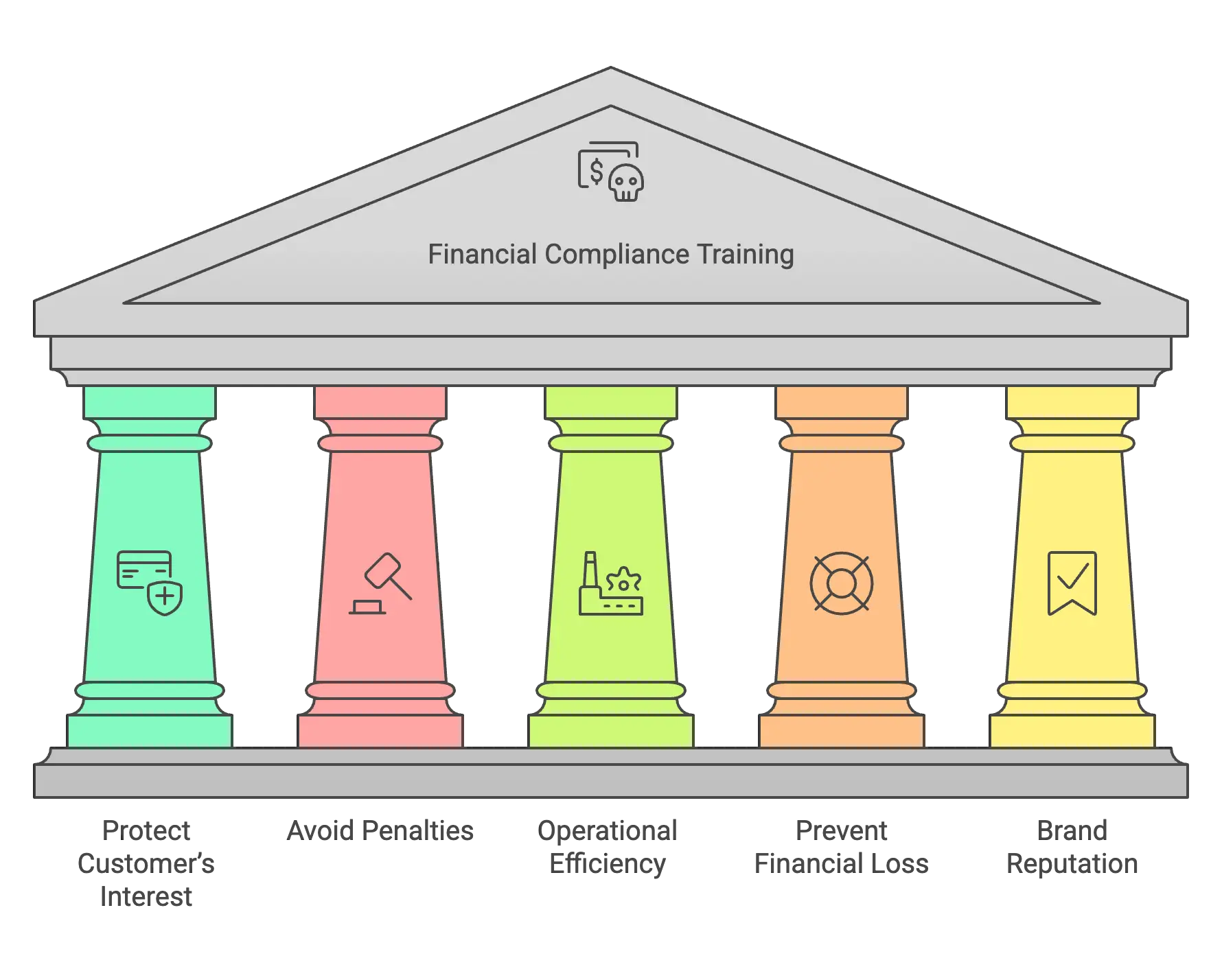

Why is Financial Compliance Training Crucial?

Financial compliance training plays a critical role in any organization. It empowers employees with a 360-degree perspective on the regulations.

Here are the benefits of having a comprehensive training module:

1. Protect Your Customer’s Interest

Thoughtfully designed compliance training offers valuable insights, making employees well-versed with the changing regulations.

- Following outdated compliance regulations can result in issues ranging from incorrect financial reports to mishandling of customer information.

- Compliance training lets employees know their role in handling finances, minimizing costly non-compliance risks, and protecting your client’s investment and interest.

2. Avoid Penalties and Legal Risks

Non-compliance can result in legal repercussions, ranging from lawsuits and penalties to imprisonment.

Providing financial compliance training to the employee is the key to avoiding these risks. The training helps employees become aware of the regulations and subsequent legal complications.

3. Improved Operational Efficiency

When employees have a clear idea of how company policy and regulatory compliance work, the chances of human errors decrease substantially.

- Proper training offers proper guidance on how to act in certain situations while adhering to the guidelines set by your company or regulatory authorities.

- Knowing perfectly how to navigate the policies, the employees can perform their roles effectively with complete peace of mind.

4. Prevent Financial Loss

One of the most prominent benefits of providing compliance training is that it can help to avoid huge financial losses.

When employees are completely knowledgeable of the company’s policy and financial industry regulations, they are less likely to make mistakes that could result in fines or expensive lawsuits.

5. Enhanced Goodwill and Brand Reputation

A strong compliance training plan is a great way to show your organization’s commitment to ethical business and financial practices. This will enhance your brand’s reputation and goodwill and boost customer trust.

As a result, your business can attract potential clients and help them build trust and loyalty.

Comprehensive Financial Compliance Training: Best Practices

Here are some of the compliance training best practices for financial institutions to ensure regulatory compliance.

- Staying Updated with the Relevant Regulations: Keep abreast of any changes in laws or guidelines that could impact your organization’s operations.

- Compliance Training Program: A thorough compliance training program ensures that employees know the relevant regulations and understand their responsibilities in maintaining compliance.

- Regular Risk Assessments: They help identify potential areas of non-compliance and allow for proactive corrective action.

- Reporting Non-Compliance: It is essential for transparency and accountability, as it identifies and mitigates risks before they escalate into more significant issues.

Conclusion

Financial training is a cornerstone of success in the finance industry, where trust, credibility, and economic stability are paramount. It’s not just about adhering to regulations; it’s about securing revenue, protecting reputation, and fostering a culture of compliance.

As you explore the significance of training, remember that it’s not an option; it’s a necessity. Stay compliant, safeguard your revenue, and let compliance be your guiding light in the finance industry.

Take the first step toward financial compliance today. Explore Hurix Digital’s comprehensive finance training services to secure your organization’s future. So what are you waiting for?

Start building a compliant and resilient financial future now!

By investing in and making finance training a priority, you’re not just protecting your revenue—you’re positioning your organization for long-term success in the challenging landscape of the finance industry. Get in touch today.

A highly enthusiastic and motivated sales professional with over twenty five years of experience in solution selling of training-related applications and services. Maintains an assertive and dynamic style that generates results. Ability to establish long-term relationships with clients built on trust, quality of service and strategic vision. Specializes in financial services, higher ed, publishing and government in the areas of learning and development.